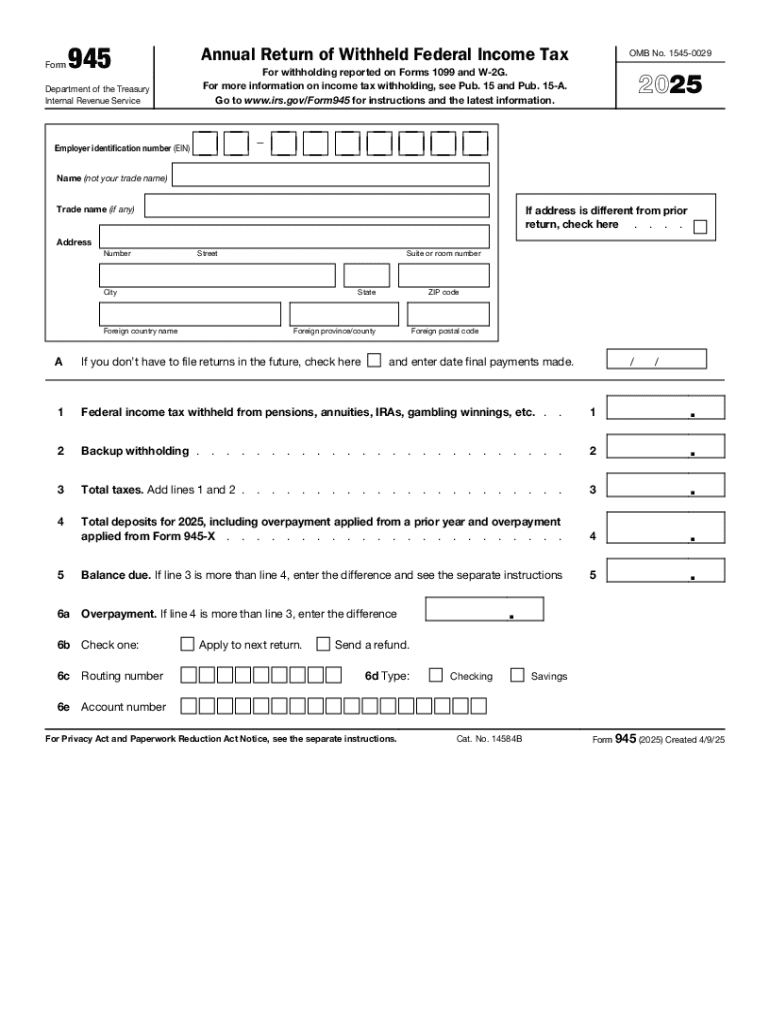

IRS 945 2025-2026 free printable template

Instructions and Help about IRS 945

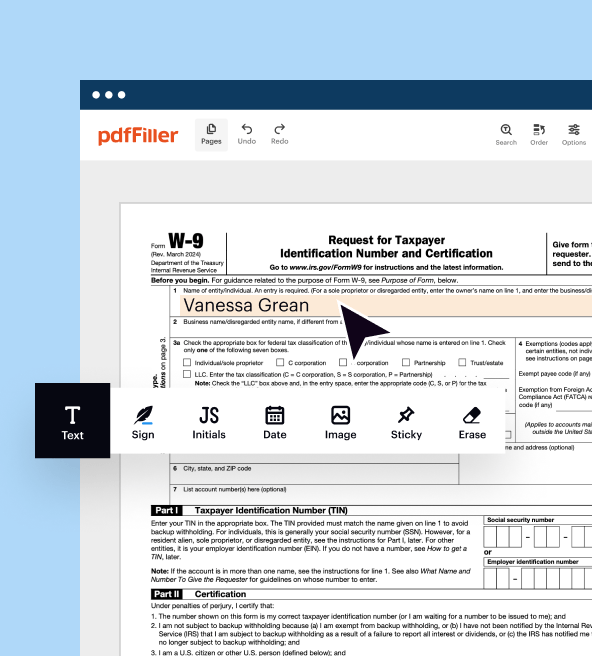

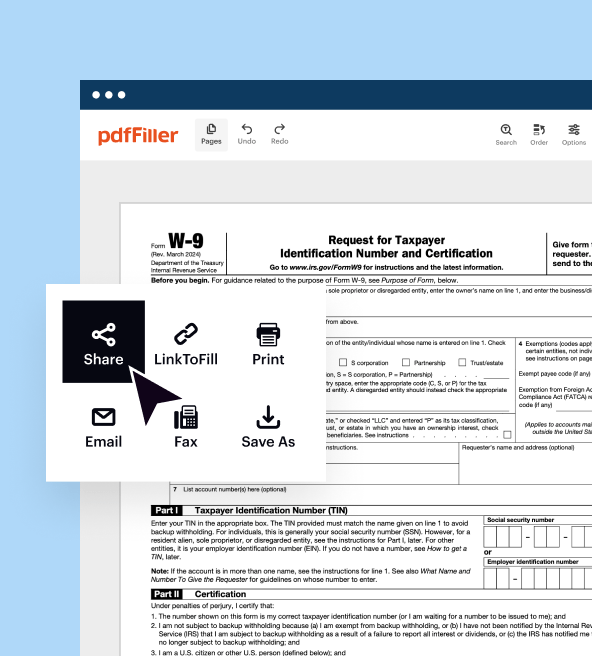

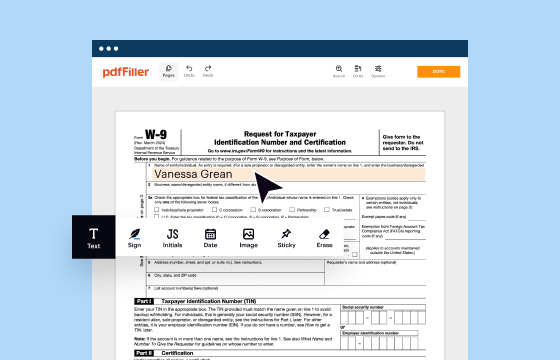

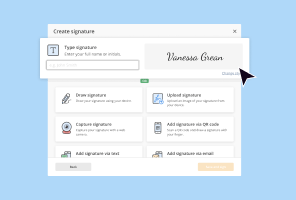

How to edit IRS 945

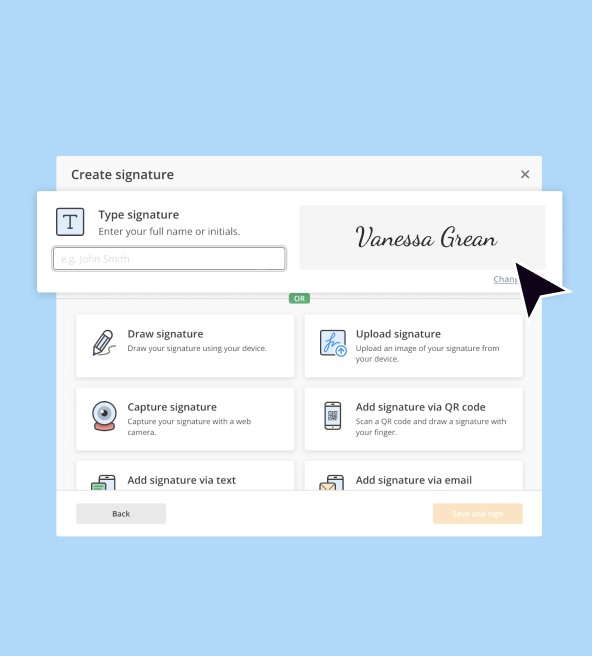

How to fill out IRS 945

Latest updates to IRS 945

All You Need to Know About IRS 945

What is IRS 945?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

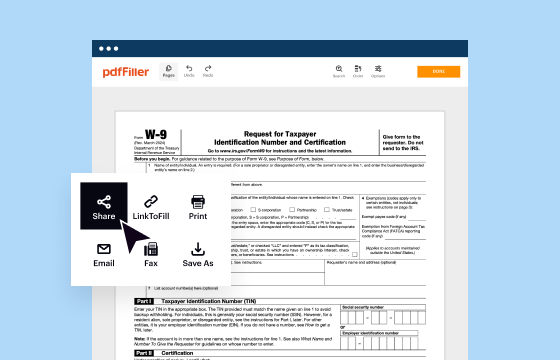

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 945

What should I do if I realize I made a mistake after submitting IRS 945?

If you discover an error in your IRS 945 after submission, you should file an amended return using Form 945-X. This form allows you to correct any mistakes and ensure the IRS has accurate information. Remember to attach a copy of your original IRS 945 with the amended form for reference.

How can I track the status of my IRS 945 submission?

You can track your IRS 945 by using the IRS e-file status tool or calling their help line for updates on processing. Be prepared with your details, such as your filing status and identification number, to verify your submission's status efficiently.

Are there specific record retention requirements for IRS 945 submissions?

Yes, the IRS recommends keeping your records related to IRS 945 for at least four years from the date you file the form. This is essential for reference in case of audits or if you need to verify any information in the future.

What common mistakes should I avoid when filing IRS 945?

Common errors include incorrect payee information, failure to report all required payments, and submitting forms with improper signatures. To prevent these mistakes, double-check all entries and ensure that you understand the reporting requirements associated with IRS 945.

Can I e-file IRS 945, and what are the technical requirements?

Yes, IRS 945 can be submitted electronically through approved e-file software. Make sure your software meets the IRS requirements and is compatible with the latest operating systems and browsers to ensure smooth submission without technical issues.

See what our users say